At the start of November, in my last blog post for my previous company, I stated that “the indications are that we are close to the bottom of the market”.

I have always said that I am not an economist, but I do look at data points, and at the end of October, everything pointed to a collapse in sentiment. One of the charts we referred to was the Fear and Greed Index, which had dropped to extreme fear.

Another piece of data we referred to was one from Bloomberg, which indicated that based on cash levels, there was a pessimistic view of markets.

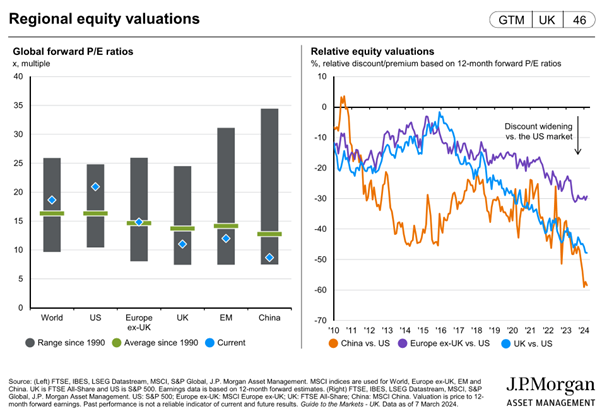

And then, we looked at regional earnings expectations and equity valuations.

It would seem my thought process was correct because we have seen a substantial recovery across many markets since November, especially the US.

2024

Below is the S&P 500 this year:

Below is the All-World Index:

In 2023, many of the gains within the US were driven by the Magnificent Seven, and although some of these have continued to push higher in 2024, the returns in the S&P500 have been more diversified.

The value of these companies is staggering:

It is also worth considering the chart below:

With the S&P500 racing ahead there is a sense that we are missing out. However, as we can see, not all the stocks that did well in 2023 have repeated in 2024.

The chart above is important because it shows how quickly technology has changed our lives in the last twenty years. We are torn as we ponder whether we should invest or if the party is over. But this chart tells us that the world changes all the time, and we can wait forever for the right moment. But when is the right moment?

Data

Turning to the Fear and Greed Index, we can see that it is sitting around the greed level today.

But the Volatility Index shows we are moving to extreme fear:

In all of this, I have focused on US data, but interestingly, global valuations remain below the average:

And this is where care should be taken; not all markets and shares are expensive. These are the expected 10 to 15-year returns.

Fear of missing out

When markets seem to be racing, there is a fear that we are missing out.

Niels Bohr, the Nobel laureate in Physics and father of the atomic model, is quoted as saying, “Prediction is tough, especially if it’s about the future!”

And this is the point of all of this. I can look at past data and suggest when I think we might be close to the bottom of the market, and I could, of course, be correct.

When I look at the future of technology, can I tell you what the Magnificent Seven will be like in ten years? The answer is no.

What next?

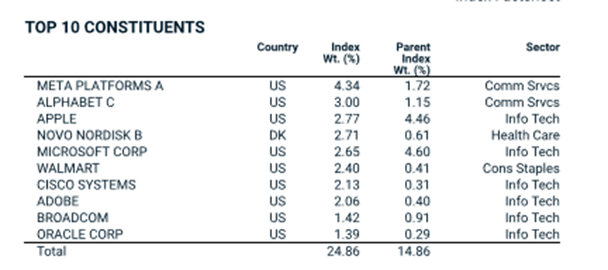

An accessible route for many is to invest in an index. The MSCI World is an example, and yet this is the composite:

What is driving returns is quality and momentum, with a focus on larger companies.

Evidence-based investing considers different factors. As an example, small-cap companies tend to outperform large-cap companies:

Also companies with lower share prices tend to outperform those with higher share prices:

If we see opportunities worldwide, we should have a more diversified view of stocks and countries.

MSCI have a World Diversified Multiple Factor Index.

It still has a high weight in the US, but it takes away that over-exposure to one style.

What is interesting is that in terms of returns, there is very little difference between the two, but the multi-factor index has removed some of that company risk from the equation.

Conclusion

The main takeaways from all of this would be:

- It does seem the market touched the point of capitulation towards the end of October.

- Although the Magnificent Seven drove the US market in 2023, not all have performed this year, providing a more diversified mix of returns.

- The US market remains expensive compared to other markets worldwide. Predicting who will be the winners within the next ten years will be impossible.

- We know with certainty that certain markets remain cheap and that certain styles tend to outperform over the long term.

Should we be worried?

If we want to buy one of the Magnificent Seven, perhaps the opportunities have gone. Maybe they haven’t, but there is enormous risk in chasing what we assume is doing well.

In 1975, William Sharpe concluded an investor employing a market timing strategy must be correct 74% of the time to beat the benchmark portfolio of similar risk annually. Choosing the right stock is hard enough, but getting the timing right is even more challenging.

The critical point is that markets will do what markets do. Trying to find the time to invest and what to invest in diminishes the idea that investing is long-term, and evidence shows that we rarely get it right when taking this approach.

Would I personally invest now?

The answer is yes because I am looking at a ten-year-plus timeframe. I know that parts of the market are cheap, but I can’t predict what will “win”. Do I feel I have missed out? My pension has gone up around 10% since November 2023, but it is still down around 10% from January 2022.

In my simple view of life, there must still be opportunities if my pension is still down from January 2022.

Disclaimer: Please note these are my thoughts. There are no recommendations within this. I am not regulated, nor can I provide advice. I would always recommend seeking advice from a financial planner before making any investment decisions. Investments can also fall and go up, and past performance is no guide to the future.

Add comment

Comments