The state pension, a cornerstone of social security, was first introduced in 1909 with a retirement age 70. However, it was not until 1928 that it was made available to all, with the retirement age lowered to 65.

According to the Department of Work and Pensions:

- Today, the government expects anyone reaching their state pension age to live another 24 years, a significant increase from the mere nine years projected in 1908.

- A quarter of all babies born now will likely live to at least 100.

- In 1909, there were half a million pensioners, now approximately 12 million.

- In 1909, there were ten workers for every pensioner: now, it’s just under 4.

- In the 1901 census, there were 1.2 million people aged over 70, and now it’s 8.8 million.

Changes to pension

A golden generation enjoyed the privileges of a final salary scheme, which guaranteed an income for life. However, many will never see the benefits of these schemes. Employers cannot afford to run them; finding out how many schemes remain is almost impossible.

The shift means there are no guarantees about what we get in retirement other than through the pension fund we build.

Of course, there are other ways to provide an income in retirement, such as property, but I will focus purely on pensions.

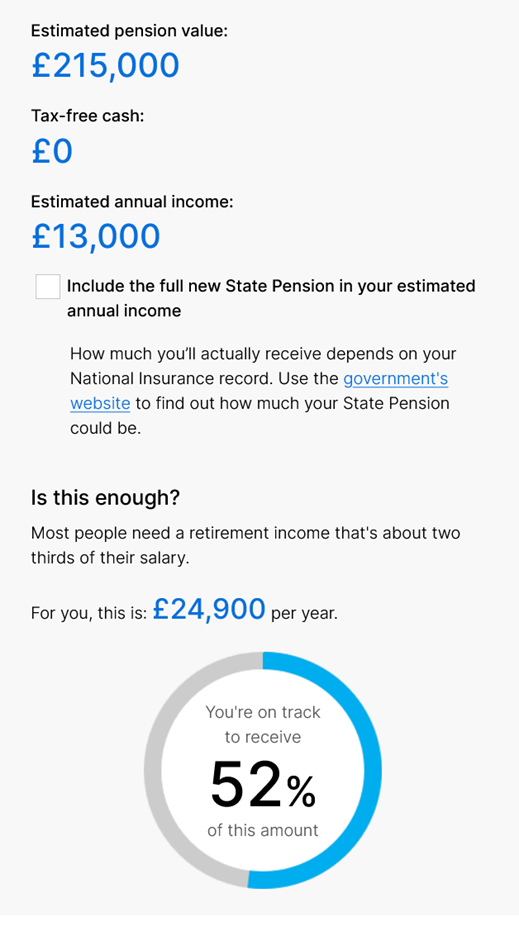

Research from Fidelity indicated that someone earning between £30,000 and £120,000 should look to secure a pension of 35% of this figure, with the state pension in addition:

How much do you need to save?

Below is the average median salary in the UK. If we take £37,382, then 35% would be £13,241.20. The state pension is £11,502.40, providing a total income of £24,743.60. (Around 66% of pre-retirement earnings).

Assuming an 18-year-old pays circa £200 a month until 68, they could theoretically achieve this, as the table below shows.

But what about retirement

The UK regulatory body (FCA) has started to raise concerns about retirement pensions. As indicated, people are living longer.

Assuming they retire at 67, their pension pot must work for them for a long time.

In 2015, the Government introduced Pension Freedom. Individuals could guarantee an income by giving their pension fund to an insurance company, and in exchange, they would get a guaranteed income for life. This is called an annuity. However, since pension freedom, the number of annuities being purchased has crumbled partly due to the rates being offered and in part to a switch to drawdown (which takes the income from the pension fund with no guarantees).

The risk that people will run out of money is becoming a concern for the regulations.

Change is coming

Considering the FCA's latest thematic review on retirement income, I question whether individuals can take income from their pension without ongoing financial advice.

Apart from that, I believe that financial planners have many opportunities to demonstrate added value, but for some, this will require a significant change to the way they do things:

- In the past, it has been assumed that people can maintain the same level of risk before and after retirement. This assumption is now being challenged.

- The FCA has indicated a conflict of interest between drawdown and annuities regarding how fees are constructed; therefore, annuities cannot be ignored.

- A retirement philosophy/process is crucial for any business.

- Management information will be vital to understanding clients, including their vulnerability and those who may run out of money.

- Financial planners will be expected to challenge clients about their income level.

- Capacity for loss is about how much people are comfortable with the fall in their assets, but this will now question the fall in income.

And so, the questions go on.

Conclusion

When the state pension first came in, most never expected to receive it. Times have changed, and we hope to live much longer into retirement. Many don’t expect to receive a state pension as it becomes unaffordable for the state to provide.

Over the last 30 years, we have seen a decline in gold-plated pensions, leaving individuals responsible for building their pension pots. It is questionable whether this can be achieved for many.

It paints a bleak future that no one feels comfortable talking about.

The second part of the problem is retirement, and now action is being taken. There will be a rush of products and solutions. Ultimately, I believe that financial planners will be the only ones able to manage retirement income. Those that don’t change and adapt will be left behind. We have included some thoughts, but the next 12 months will be vital for those who want to lead the field. There are already financial planners who have a process in place.

Pre- and post-retirement planning is becoming even more complicated. Careful management will be vital. But while we develop these propositions, it is just as important to consider how to save for retirement.

Disclaimer: Please note these are my thoughts. There are no recommendations within this. I am not regulated, nor can I provide advice. I would always recommend seeking advice from a financial planner before making any investment decisions. Investments can also fall and go up, and past performance is no guide to the future.

Add comment

Comments