From an investment perspective, markets seemed to have little joy, with October reflecting a total capitulation. Most investors had never experienced a period such as this. For almost two years, returns have been negative.

The CNN Fear and Greed Index reflects the sentiment within US markets during 2023.

Light at the end of the tunnel

In my last “Howay the Ladds” blog, I reflected on the cycle of market emotions.

The view was that following the collapse of markets in October, we were close, if not at the bottom of the market cycle. I have never tried to be an economist, but the following charts indicate what might happen next.

The table from the Investment Association shows money movements, and we can see money coming out of equities in September. The stage of panic, and so we saw markets collapse in October.

However, markets are forward-looking, and what they crave is certainty. Markets can see an end to the interest rate cycle and falling inflation, which has fed into the recovery we have seen in November and December.

We closely follow the Anatomy of a Recession, and we have seen a slight improvement in sentiment in the US.

If we are close or near the bottom, investors should expect heightened volatility until there is greater visibility regarding economies and company earnings.

The chart below is also essential as it shows that not all markets are cheap. But there are opportunities. A few companies skew the US market.

This is reflected in the chart below, which shows the long-term asset return expectations.

It is probably worth reflecting on this chart from Fidelity. Staying fully invested rather than trying to time the market often delivers the best results.

Politics and 2024

Some argue that the October 7 attack will have the same impact in the Middle East as September 11 did in the US and globally. Perhaps the biggest surprise is that, as yet this has not spread into a wider conflict across the Middle East.

For 2024, this is something to watch; a wider conflict could force up oil prices and cause inflation to rise and, therefore, have an unsettling impact on markets. The whole situation is both tragic and complicated, and any resolve is hard to see.

Likewise, the war in Ukraine rumbles on, and the US has made what could be its final military aid to Ukraine. This may enable Russia to push forward. The reality, as we have always said, is that this is Russia’s new Afghanistan. There seems to be no positive outcome from this unless there is a change in government in Russia, and there is no guarantee that this will happen anytime soon, nor that any new government will change direction.

The US election will be the key focus for 2024. Below are some recent polls:

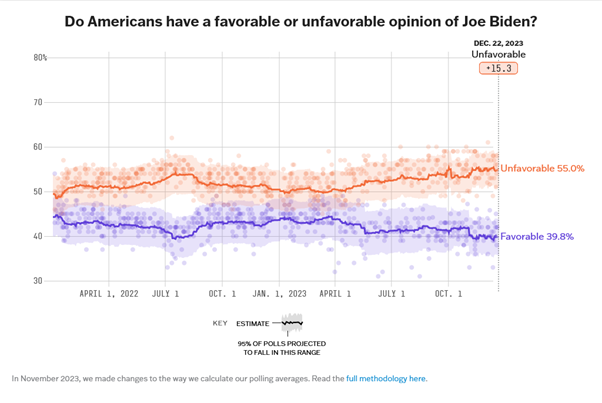

The charts below show favourability ratings:

In theory, even if Trump went to prison, he could become President; however, states such as Colorado and Maine have blocked Trump from standing. The question is whether momentum builds and who can stand instead of Trump. If Trump comes into power, this will have fundamental repercussions across the US and the world, and many fear this.

The question is whether Biden should step aside. He only took on the challenge when it was felt there was no one better within the Democratic Party. There is still support for Biden within the party, but would he be strong enough to see off Trump?

The biggest concerns are his age and whether he can finish his second term.

Like the Republicans, the question is if not Biden, then who, and that remains the million-dollar question.

There is much to play for, and high stakes are at play, making markets nervous.

In the UK, the first past the post-election process makes it almost impossible for Labour to form a majority government without winning seats in Scotland. Every seat they win in Scotland increases the chances of Keir Starmer's getting a majority.

Where the SNP held a majority in Scotland, the party's implosion and a weak leader opens opportunities for Labour. The chart below shows how support for SNP is falling and Labour is gaining momentum.

It is estimated that if Labour can win over one in five SNP voters. 20 seats are within their grasp. Labour holds a sizable lead in the opinion polls. The question is whether they will repeat 1997.

There is much argument over whether a Labour or Conservative Government is better for markets.

The chart below shows the growth by administration since 1955.

To quote “The Conversation”:

“If we disregard the global financial crisis as an external shock, Labour has presided over just two recession quarters since 1955, and has produced average annualised growth of 2.66%. If we similarly disregard the three quarters following the 1973 oil shock that took place under the Conservative administration of Ted Heath, his party has presided over 14 recession quarters and 2.65% of average annualised growth.”

Despite the headlines, there is little evidence that a Labour Government is bad for markets. Whoever wins the election, the UK faces several challenges, but the impact of either a Conservative or Labour victory will be minimal in terms of markets.

2023 and beyond – a conclusion

As 2023 ends, there appear to be some positive signs within markets. It seems that the turning point came in October. Falling inflation and a signal that interest rate hikes are ending provide markets with the certainty they crave.

The recovery is unlikely to be smooth. There remains uncertainty within the Middle East and a danger that the conflict between Israel and Gaza could spread and draw other nations in.

Within the US, a Trump victory would be negative globally, and we should not underestimate the risk of this happening.

In terms of the UK, everything points to a Labour victory, but Scotland is the key. In terms of markets, evidence indicates that whoever wins will make little difference to markets.

To conclude, since November, we have felt cautious optimism about returns, and despite the potential challenges for 2024, we continue to hold that view.

Add comment

Comments

Really helpful diagrams that bring the information to Life. Do you think the recommencement of interest rate rises in the UK will mirror those in America?

Hi Brad, it is a fair comment. We know with certainty that, at some point, interest rates will peak and come down. We are more likely to see them come down from this point. However, rates may begin to rise if inflation starts to get out of control. There are risks, especially around the Middle East. Markets are probably more accepting that the worst is behind us.